“Finding cheap car insurance in Nevada for 2024 requires understanding coverage options, discounts, and comparison tools.”

Finding cheap car insurance in Nevada for 2024 can help drivers save money while still getting necessary coverage. Nevada has unique factors, such as its busy highways and desert conditions, which impact insurance costs. Drivers should compare quotes from multiple providers, consider discounts, and choose the right policy to get the best deal.

In this article, we will look at the factors that affect car insurance rates in Nevada, the best ways to find affordable coverage, and tips to save money on your premium.

Why Car Insurance Rates in Nevada Are High

Car insurance rates in Nevada tend to be higher than the national average. One reason is the state’s large cities, like Las Vegas and Reno, which have higher accident rates.

Also, Nevada’s climate can lead to weather-related claims, which increase costs for insurers. These factors contribute to higher rates across the state.

Factors That Affect Car Insurance in Nevada

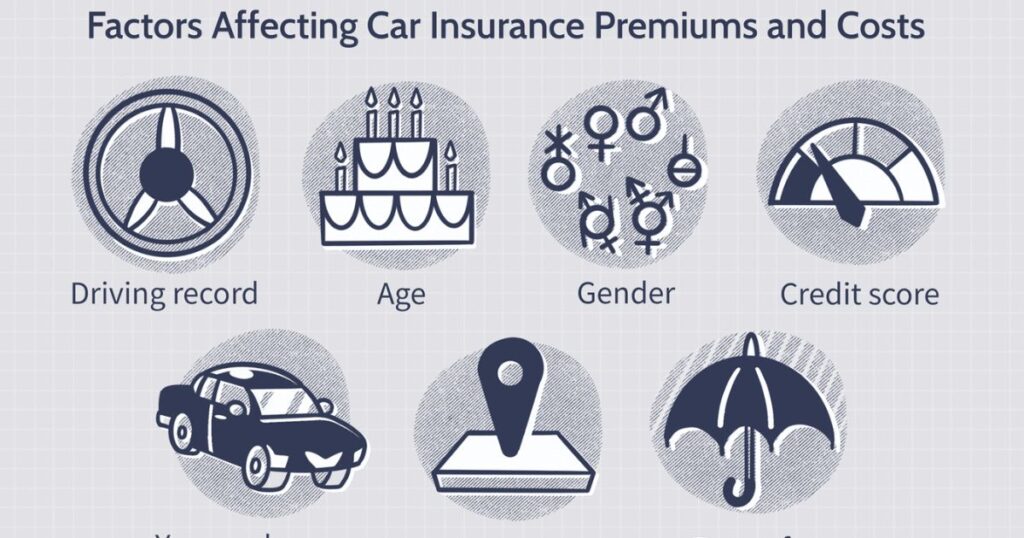

Several factors influence car insurance premiums in Nevada. Your age, driving history, and location play important roles. Living in a high-traffic area may raise your rates.

Additionally, your car’s make and model, credit score, and driving record can also impact the cost of your insurance.

Minimum Insurance Requirements in Nevada

Nevada requires all drivers to carry a minimum level of insurance coverage. The minimum limits include $25,000 for bodily injury per person, $50,000 per accident, and $20,000 for property damage.

While these are the minimums, many drivers choose to purchase higher coverage to better protect themselves in case of accidents.

Finding Cheap Liability Insurance in Nevada

Liability insurance covers damages to other people in accidents you cause. In Nevada, it’s often the cheapest type of car insurance.

Many drivers in Nevada opt for liability-only insurance to save money, especially if they drive an older vehicle that doesn’t need full coverage.

Cheap Full Coverage Car Insurance Options

Full coverage insurance includes liability, collision, and comprehensive coverage. While full coverage is more expensive, it offers more protection in case of accidents or other incidents like theft or weather damage.

For Nevada drivers looking for cheap full coverage, comparing quotes from multiple companies is key to finding affordable options.

Discounts That Can Help You Save on Insurance

Many insurance companies offer discounts to help lower your premium. Discounts can include safe driving, bundling policies, or having a clean driving record.

Some Nevada insurers also offer good student discounts or discounts for completing a defensive driving course. Be sure to ask about all available discounts when shopping for insurance.

How Your Driving Record Affects Your Rates

Your driving record has a significant impact on your car insurance rates in Nevada. Drivers with a history of accidents or traffic violations will likely pay more.

On the other hand, a clean driving record can help you qualify for lower premiums and special discounts.

The Role of Credit Scores in Nevada Car Insurance

Many insurers in Nevada use credit scores to help determine insurance rates. Drivers with good credit often receive lower premiums because they’re viewed as less risky.

Improving your credit score could help you lower your car insurance costs over time.

Average Car Insurance Rates by Age and Gender

Best Car Insurance Companies in Nevada for 2024

Several companies offer affordable car insurance in Nevada for 2024. Some of the best options include State Farm, GEICO, and Progressive.

These companies are known for competitive rates and a variety of discounts that can help Nevada drivers save money.

Comparing Quotes to Find Cheap Car Insurance

To find the best rates, it’s important to compare quotes from multiple insurers. Each company uses different factors to determine rates, so you may find a significant price difference between companies.

Using online comparison tools can make this process quick and easy.

How Nevada’s Weather Impacts Insurance

Nevada’s desert climate and extreme heat can affect car insurance rates. Heat can lead to more vehicle breakdowns or tire damage, which may result in more claims.

Insurance companies factor in these risks when determining your premium.

Nevada’s High Traffic Areas and Insurance Costs

Cities like Las Vegas and Reno have heavy traffic, which increases the risk of accidents. Higher accident rates lead to higher insurance premiums for drivers in these areas.

If you live in a rural area, you may be able to get cheaper car insurance due to lower accident risks.

The Importance of Uninsured/Underinsured Motorist Coverage

Nevada has a significant number of uninsured drivers on the road. Purchasing uninsured/underinsured motorist coverage is a smart way to protect yourself in case you’re in an accident with a driver who doesn’t have adequate insurance.

This coverage can save you from paying out of pocket for repairs or medical bills.

Temporary Car Insurance for Nevada Drivers

If you’re visiting Nevada for a short time or need coverage for a limited period, temporary car insurance might be an option. Temporary insurance can cover you for anywhere from one day to a few months.

This can be a cost-effective solution for drivers who don’t need a long-term policy.

How to Lower Your Car Insurance Rates in Nevada

To lower your car insurance rates in Nevada, maintain a clean driving record and keep your credit score high. You can also raise your deductible to lower your monthly premium.

Taking advantage of discounts and shopping around for better rates will also help you save money on your car insurance.

Understanding SR-22 Insurance in Nevada

Drivers in Nevada who have had serious traffic violations may be required to file an SR-22 form. SR-22 insurance is often more expensive due to the higher risk involved.

If you need SR-22 insurance, shop around to find the best rate from different insurers.

Common Mistakes to Avoid When Buying Car Insurance

When purchasing car insurance in Nevada, avoid choosing the minimum coverage if you can afford better protection. Many drivers also make the mistake of not comparing quotes from different companies.

Be sure to check for discounts and avoid letting your policy lapse, which can lead to higher rates later.

The Future of Car Insurance in Nevada

As we move into 2024, expect changes in car insurance as companies continue to adapt to new technologies and driving habits. More insurers may offer usage-based insurance, which charges based on how much you drive.

With these changes, drivers in Nevada may see more personalized and affordable insurance options in the future.

FAQs

How can I find cheap car insurance in Nevada?

You can find cheap car insurance by comparing quotes from multiple companies, maintaining a clean driving record, and looking for discounts.

What’s the minimum car insurance required in Nevada?

Nevada requires at least $25,000 in bodily injury per person, $50,000 per accident, and $20,000 for property damage.

Does my credit score affect my car insurance rates in Nevada?

Yes, many insurance companies use credit scores to determine rates. Drivers with higher scores often receive lower premiums.

Can I get temporary car insurance in Nevada?

Yes, temporary car insurance is available in Nevada, providing short-term coverage for specific needs like rental cars or short stays.

Why are car insurance rates higher in Las Vegas?

Las Vegas has a high rate of traffic accidents, which increases the cost of insurance for drivers in the area.

Conclusion

Finding cheap car insurance in Nevada for 2024 is possible with the right approach. By comparing quotes, maintaining a good driving record, and taking advantage of discounts, drivers can save money on their premiums. Nevada’s unique traffic and weather conditions affect insurance rates, so it’s important to consider these factors when choosing coverage

Hi! I’m Semuel Adams. I’m a business expert and author at SkyVoxes. With a Master’s degree in Business, I’m passionate about sharing practical advice and strategies to help businesses thrive. My goal is to make complex business concepts easy to understand and apply. If you have any tips or information about business you can share with me, I w’ll add this important information in my content.