“Understanding car insurance is crucial for teens and young drivers to find affordable coverage and stay safe on the road.”

Getting car insurance can be confusing for teens and young drivers. Understanding the costs and options available is essential for new drivers. This article will cover everything you need to know about car insurance for teens and young drivers. We will explore the factors that affect rates, how to find the best coverage, and tips for staying safe on the road.

Why Car Insurance is Important for Teens

Car insurance is essential for all drivers, especially teens. It protects you financially in case of an accident.

Teen drivers are more likely to get into accidents. Having insurance provides peace of mind and support in emergencies.

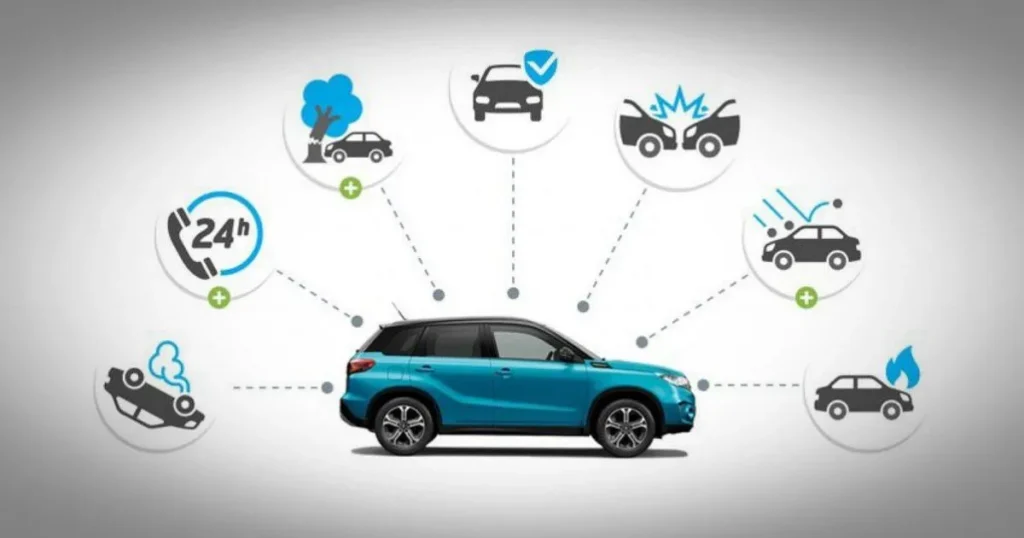

Understanding Different Types of Coverage

There are various types of car insurance coverage. These include liability, collision, and comprehensive coverage.

Liability insurance pays for damage to others if you cause an accident. Understanding these options helps you choose the right plan.

Factors Affecting Insurance Rates for Teens

Several factors can influence car insurance rates for young drivers. Age, gender, and driving experience all play a role.

Younger drivers typically face higher rates due to their lack of experience. Insurance companies assess risk based on these factors.

How to Find the Best Car Insurance

Finding the best car insurance for teens requires research. Start by comparing quotes from multiple providers.

Look for companies that offer discounts for young drivers. This can help you save money on premiums.

Discounts for Young Drivers

Many insurance companies offer discounts specifically for young drivers. These can include good student discounts and safe driving incentives.

Ask about any available discounts when getting quotes. This can significantly lower your insurance costs.

The Role of Your Driving Record

Your driving record is crucial in determining your insurance rates. A clean record can lead to lower premiums.

If you have accidents or tickets, your rates may increase. Keeping a good driving record is essential for saving money.

Cheap Full Coverage Car Insurance

Choosing the Right Vehicle

The type of vehicle you drive can impact your insurance rates. Cars with high safety ratings usually cost less to insure.

Consider the make and model when shopping for a car. A safe car can save you money on insurance.

Understanding Liability Coverage

Liability coverage is a legal requirement in most states. It covers damages to others in an accident you cause.

Understanding the limits of your liability coverage is important. Make sure you have enough protection to avoid financial issues.

Collision and Comprehensive Coverage Explained

Collision coverage pays for damage to your car after an accident. Comprehensive coverage protects against theft and natural disasters.

Both types of coverage are optional but can be helpful. Assess your needs before deciding if they are right for you.

The Importance of Deductibles

A deductible is the amount you pay before your insurance covers a claim. Higher deductibles often mean lower monthly premiums.

Consider how much you can afford when choosing a deductible. Finding the right balance is essential for financial security.

Bundling Insurance Policies

Bundling your car insurance with other policies can save you money. Many insurers offer discounts for multiple policies.

If your family has home or renters insurance, ask about bundling. This can provide significant savings on your overall costs.

How to Stay Safe on the Road

Safe driving practices are crucial for all drivers, especially teens. Always wear your seatbelt and avoid distractions while driving.

Taking a defensive driving course can also help. These courses can teach valuable skills to keep you safe.

The Role of Parental Guidance

Parental guidance can be beneficial for young drivers. Discuss driving rules and safety practices with your parents.

Many insurance companies allow parents to add their teens to their policies. This can provide additional savings and support.

Using Technology to Your Advantage

Many insurance companies now offer apps to help young drivers. These apps can track your driving habits and offer discounts for safe driving.

Using technology can help you stay informed about your driving. This can lead to better habits and lower insurance rates.

The Benefits of a Good Student Discount

Many insurance companies offer discounts for students with good grades. Maintaining a high GPA can lead to lower premiums.

Be sure to ask your insurer about this discount. This can be an easy way to save money on insurance.

Keeping Up with Insurance Changes

Insurance policies can change, so it’s important to stay informed. Regularly review your policy to ensure it meets your needs.

Keep an eye on industry trends that may affect your rates. Being proactive can save you money and hassle.

Preparing for Renewal

When your policy is up for renewal, review your options. Compare quotes from other providers to see if you can save money.

Ask your current insurer about any new discounts or offers. This can help you make the best decision for your coverage.

Getting Help from Insurance Agents

If you’re unsure about your insurance options, seek help from an insurance agent. They can explain policies and find the best coverage for you.

Insurance agents can also assist with claims and renewals. Having professional guidance can make the process easier.

FAQs

Why is car insurance important for teens?

Car insurance protects you financially in case of an accident and is required by law.

What factors affect car insurance rates for young drivers?

Age, gender, driving experience, and vehicle type all influence insurance costs for teens.

How can I find the best car insurance for a young driver?

Compare quotes from multiple providers and look for discounts specifically for young drivers.

What discounts are available for young drivers?

Discounts may include good student discounts, safe driving incentives, and multi-policy bundling.

What is a deductible?

A deductible is the amount you pay before your insurance covers a claim; higher deductibles usually mean lower premiums.

Conclusion

Car insurance is crucial for teens and young drivers. Understanding coverage options, rates, and discounts can save you money. By following safe driving practices and maintaining a good driving record, you can keep your premiums low. Always stay informed about your options and seek help when needed.