“This review covers Globe Life Insurance’s offerings, customer service, and benefits in 2024.”

Globe Life Insurance is a popular choice for many. It offers affordable life insurance products for individuals and families. In this article, we will examine Globe Life’s features, benefits, and customer feedback. This review will help you understand if Globe Life Insurance is the right choice for you in 2024.

Overview of Globe Life Insurance

Globe Life Insurance has been in business for over 60 years. The company focuses on providing simple and affordable life insurance products.

Globe Life is based in McKinney, Texas. It serves customers across the United States. Their mission is to offer peace of mind through life insurance.

Types of Insurance Offered

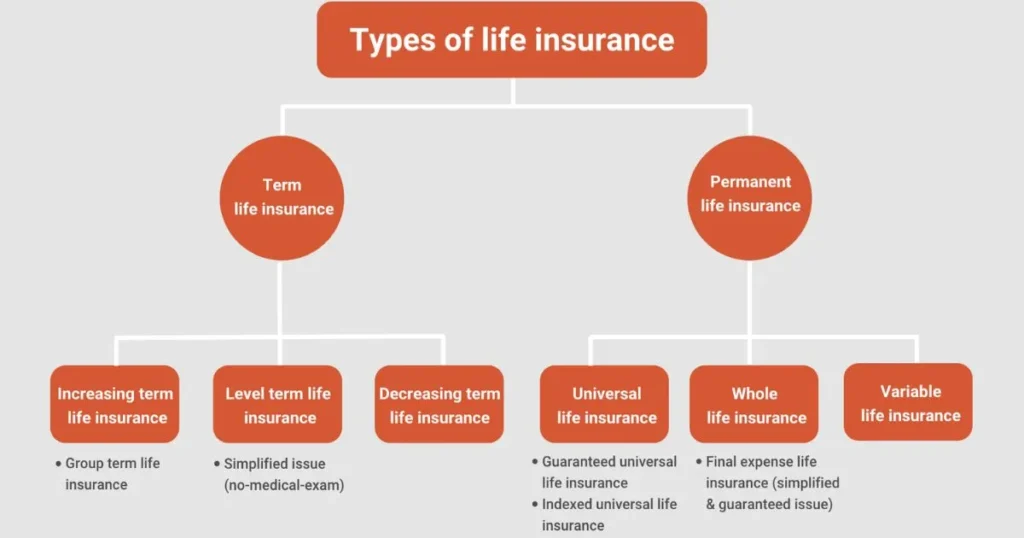

Globe Life offers various types of insurance. The main types include term life insurance and whole life insurance.

Term life insurance provides coverage for a set period. Whole life insurance lasts for the insured’s lifetime.

Key Features of Globe Life Insurance

One key feature of Globe Life Insurance is no medical exam for most policies. This makes it easy to get coverage quickly.

Another feature is the guaranteed acceptance for certain policies. This means you cannot be denied coverage based on health.

Premiums and Payment Options

Globe Life Insurance offers affordable premiums. Rates start as low as $1 for the first month.

You can pay premiums monthly, quarterly, or annually. This flexibility helps customers choose a plan that fits their budget.

Customer Service and Support

Customer service is important in the insurance industry. Globe Life offers support through phone and online channels.

They provide a 24/7 customer service line. This ensures help is available whenever you need it.

Online Account Management

Globe Life has an online portal for policy management. Customers can easily manage their policies and make payments online.

The portal is user-friendly and accessible from any device. This feature simplifies policy management.

Claims Process

Filing a claim is a crucial part of insurance. Globe Life aims to make the claims process simple and straightforward.

To file a claim, you can call customer service or submit a form online. The company strives for quick processing of claims.

TIAA Life Insurance Review 2024

Financial Strength and Stability

When choosing an insurance company, financial strength matters. Globe Life has a solid financial rating from A.M. Best.

This rating indicates the company is stable and can meet its obligations. It provides peace of mind for policyholders.

Discounts and Benefits

Globe Life Insurance offers various discounts. For example, they provide discounts for multiple policies.

These discounts help reduce overall premium costs. It makes Globe Life a cost-effective choice for families.

Customer Reviews and Feedback

Customer feedback is essential in evaluating an insurance company. Many customers praise Globe Life for its affordability and ease of use.

However, some customers report challenges with claims processing. It’s essential to consider both positive and negative reviews.

Comparison with Other Insurance Companies

Comparing Globe Life to other insurers is important. It helps you see how their offerings stack up.

Globe Life is often more affordable than many competitors. However, coverage options may be more limited.

The Application Process

Applying for Globe Life Insurance is easy. You can apply online or over the phone.

The application requires basic personal information. Most applicants can receive instant approval.

Pros and Cons of Globe Life Insurance

Understanding the pros and cons helps in decision-making. The pros include low premiums and no medical exams.

The cons may include limited coverage options. It’s essential to weigh these factors before choosing.

Recommendations for Potential Customers

Before purchasing, assess your life insurance needs. Consider how much coverage your family might need.

It’s also helpful to compare quotes from multiple companies. This ensures you find the best policy for your situation.

Life Insurance and Financial Planning

Life insurance plays a vital role in financial planning. It provides financial security for your loved ones.

Having life insurance ensures your family can pay bills, mortgages, or education costs after your passing.

Tips for Choosing Life Insurance

When choosing life insurance, consider your needs. Assess how much coverage your family will need.

Also, think about your budget and how much you can afford in premiums. It’s crucial to find a policy that fits both.

Final Thoughts on Globe Life Insurance

In conclusion, This Life Insurance offers a variety of options. Its affordability and no medical exam policy are attractive features.

However, it’s essential to consider coverage limits and customer feedback. Take your time to evaluate if Globe Life is right for you.

FAQs

What types of life insurance does Globe Life offer?

Globe Life offers term and whole life insurance policies.

Is there a medical exam required for coverage?

Most policies do not require a medical exam.

Can I manage my policy online?

Yes, Globe Life has an online portal for easy management.

What is the claims process like?

The claims process is simple, and you can file online or via phone.

Are there discounts available?

Yes, Globe Life offers discounts for multiple policies.

Conclusion

Globe Life Insurance provides a range of options for those seeking coverage. With its low premiums and easy application process, it’s an appealing choice for many. However, it’s essential to read reviews and understand your needs. This way, you can make an informed decision about your life insurance needs in 2024.