“Renters insurance protects your belongings and provides liability coverage for accidents in your rental home.”

Renters insurance is a simple and affordable way to protect your personal belongings. It also offers liability protection if someone gets hurt in your rented space. This article explains renters insurance works and why it’s important for renters to consider this coverage.

What Is Renters Insurance?

Renters insurance is a type of coverage for people who rent their homes. It protects personal belongings from damage or theft. Unlike homeowner’s insurance, renters insurance doesn’t cover the building itself, only the tenant’s possessions.

Renters insurance also provides liability protection. This means if someone gets injured in your rental, the policy may help cover medical expenses or legal fees.

Why Do You Need Renters Insurance?

Renters insurance is essential because accidents and theft can happen anytime. If your belongings are stolen or damaged, renters insurance can help replace them. It ensures you won’t have to pay out of pocket for losses.

Additionally, landlords often require renters insurance. This protects both the tenant and the landlord by providing coverage for potential accidents or damages.

What Does Renters Insurance Cover?

Renters insurance typically covers three main areas: personal property, liability, and additional living expenses. Personal property coverage protects items like furniture, electronics, and clothing from theft, fire, or water damage.

Liability coverage helps pay for medical bills or legal fees if someone is injured in your home. Additional living expenses cover hotel or rental costs if your home becomes uninhabitable due to a covered event.

Personal Property Coverage

Personal property coverage is one of the most important features of renters insurance. It covers your belongings, such as electronics, clothing, and furniture. If they are stolen or damaged, renters insurance can help you replace them.

The policy usually covers items damaged by fire, water, or theft. However, it may not cover damages caused by floods or earthquakes unless additional coverage is purchased.

Liability Coverage

Liability coverage is essential in case someone gets hurt in your rental home. If a guest trips and falls, you could be held responsible for their medical expenses. Renters insurance helps cover these costs.

This coverage can also protect you in case of lawsuits. If someone sues you for damages, the insurance may help cover legal fees.

Additional Living Expenses

Sometimes, accidents can make your rental unlivable. For example, if a fire damages your apartment, you might need to stay in a hotel while repairs are made. Renters insurance covers additional living expenses like hotel bills or temporary rent.

This ensures you have a place to stay without worrying about the extra costs. It can be a lifesaver during unexpected events.

Does Renters Insurance Cover Bed Bugs?

What Renters Insurance Doesn’t Cover

While renters insurance covers many things, it has limitations. It usually doesn’t cover damages from floods or earthquakes. For those events, you will need separate coverage.

Additionally, renters insurance may not cover high-value items like expensive jewelry or art. You can purchase additional coverage, known as a rider, to protect these items.

How to Choose the Right Renters Insurance Policy

Choosing the right policy depends on your needs and budget. First, determine how much coverage you need for your belongings. Make a list of your valuable items and their worth.

Next, decide on the level of liability coverage. If you have frequent guests or pets, higher liability coverage is a good idea. Finally, compare rates and features from different insurance companies to find the best deal.

How Much Renters Insurance Do You Need?

The amount of renters insurance you need depends on the value of your belongings. Create an inventory of your items and estimate their replacement cost. This will help you decide on the right coverage.

Also, consider your liability coverage needs. If you host guests often or live in a high-traffic area, you might need more coverage for accidents or damages.

Cost of Renters Insurance

Renters insurance is usually affordable. On average, renters insurance costs between $15 and $30 per month. However, the price may vary based on the amount of coverage, location, and the insurance company.

You can save money by bundling renters insurance with other policies, like auto insurance. Some companies also offer discounts for having safety features, such as smoke detectors.

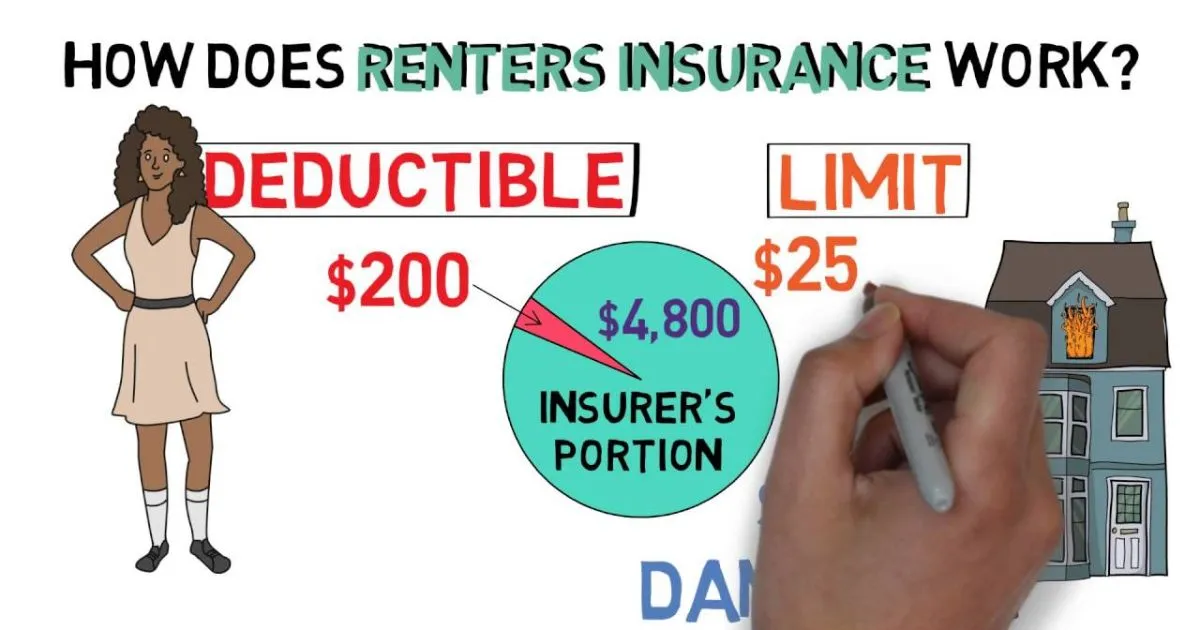

Deductibles in Renters Insurance

A deductible is the amount you pay out of pocket before your insurance kicks in. Renters insurance policies usually have deductibles ranging from $250 to $1,000. Choosing a higher deductible can lower your monthly premium.

However, make sure the deductible is an amount you can afford to pay if you need to file a claim.

Filing a Renters Insurance Claim

If something happens, filing a renters insurance claim is simple. Start by reporting the incident to your insurance company. Provide details like the date, time, and cause of the damage or theft.

Your insurer will review the claim and, if approved, issue a payout. Be sure to keep receipts and photos of your belongings to make the claims process smoother.

Common Renters Insurance Discounts

Many insurance companies offer discounts to make renters insurance more affordable. One common discount is for bundling renters and auto insurance policies. You may also get a discount for having security devices like smoke detectors or alarms.

Some companies offer lower rates if you have a good credit score. Always ask about available discounts when shopping for a policy.

Is Renters Insurance Required?

In many cases, landlords require renters insurance as part of the lease agreement. This protects both the tenant and the landlord in case of accidents. Even if it’s not required, renters insurance is highly recommended.

Without renters insurance, you could be left paying for damages out of pocket. This can be costly and stressful in an emergency.

Differences Between Renters and Homeowners Insurance

Renters and homeowners insurance serve different purposes. Renters insurance covers the tenant’s personal belongings, while homeowners insurance covers the structure of the home.

Homeowners insurance also protects the homeowner’s property, whereas renters insurance focuses on personal property and liability. If you rent, renters insurance is a more affordable option than homeowners insurance.

How to Buy Renters Insurance

Buying renters insurance is easy and can be done online or through an insurance agent. First, research different companies and compare quotes. Make sure to choose the right coverage amount for your belongings and liability needs.

Once you’ve selected a policy, you can apply online or over the phone. Most policies are active within a day or two, providing immediate coverage.

Does Renters Insurance Cover Roommates?

Renters insurance usually covers only the policyholder and their belongings. It doesn’t automatically cover roommates unless they are listed on the policy. If you share a home with roommates, they should get their own renters insurance policy.

Sharing a policy with a roommate can get complicated if a claim is filed. It’s best to have separate policies to avoid confusion.

Additional Coverage Options for Renters Insurance

While basic renters insurance covers many things, additional riders can expand your coverage. For example, if you own valuable jewelry or electronics, you may want to purchase extra protection.

You can also add coverage for specific risks, like floods or earthquakes. These add-ons ensure your policy fits your unique needs and gives you full peace of mind.

FAQs

How much does renters insurance cost?

Renters insurance typically costs between $15 and $30 per month. Prices vary based on coverage and location.

Does renters insurance cover theft?

Yes, renters insurance covers theft of personal belongings. It also covers damage caused by fire, water, and other named risks.

Do I need renters insurance if my landlord has insurance?

Yes, your landlord’s insurance only covers the building. Renters insurance protects your personal property and provides liability coverage.

What is a renters insurance deductible?

A deductible is the amount you pay before your insurance starts covering the costs. Typical deductibles range from $250 to $1,000.

Can I get a discount on renters insurance?

Yes, many companies offer discounts for bundling policies or having safety features. Ask your insurer about available discounts.

Conclusion

Renters insurance is an affordable and essential way to protect your personal belongings. It covers damage from theft, fire, and other risks, while also providing liability coverage. Whether required by your landlord or chosen for peace of mind, renters insurance ensures you’re financially secure in the event of an emergency.

Hi! I’m Semuel Adams. I’m a business expert and author at SkyVoxes. With a Master’s degree in Business, I’m passionate about sharing practical advice and strategies to help businesses thrive. My goal is to make complex business concepts easy to understand and apply. If you have any tips or information about business you can share with me, I w’ll add this important information in my content.