“Learn how to estimate car insurance costs before buying a car to avoid surprises. This guide provides tips and insights to help you make informed decisions.”

Estimating car insurance costs is an essential step before buying a vehicle. Understanding these costs can help you make an informed decision. Insurance rates can vary based on several factors, including the type of car and your driving history.

This article will guide you through the process of estimating car insurance costs before making a purchase.

Why Estimate Insurance Costs?

Estimating insurance costs helps you budget for your new car. Knowing these expenses can prevent surprises later.

Insurance is an ongoing cost of car ownership. It is important to factor this into your total expenses.

Factors Influencing Insurance Costs

Many factors affect your car insurance rates. These include your age, driving record, and credit score.

Additionally, the car’s make and model also play a significant role. Cars with high safety ratings typically have lower premiums.

Researching Vehicle Types

Different types of vehicles have different insurance costs. For example, sports cars often cost more to insure than sedans.

Research various models to find those with lower insurance rates. This can help you make a more budget-friendly choice.

Understanding Coverage Levels

Insurance policies offer various coverage levels. These can affect your monthly premium.

Higher coverage limits usually mean higher costs. Understanding your needs will help you choose the right coverage.

Getting Quotes from Multiple Insurers

Always obtain quotes from multiple insurance providers. This allows you to compare prices and coverage options.

Use online tools or contact agents for quotes. Having several options helps you find the best deal.

Using Online Insurance Calculators

Online insurance calculators can provide quick estimates. These tools help you understand potential costs based on your chosen car.

Simply enter your details, and the calculator will provide an estimate. This is an easy way to get a rough idea of costs.

Get Car Insurance Quotes For Free Online

Checking State Insurance Requirements

Each state has minimum insurance requirements. Familiarize yourself with these laws to ensure you comply.

Understanding these requirements helps you avoid penalties. It also informs your coverage decisions.

The Role of Your Driving Record

Your driving history significantly impacts your insurance rates. A clean record usually results in lower premiums.

Conversely, accidents or tickets can raise your costs. Knowing your driving record is crucial when estimating insurance costs.

Considering Your Credit Score

Your credit score can also affect your car insurance rates. Many insurers use this score to assess risk.

A higher credit score often leads to lower premiums. Improving your credit can save you money on insurance.

The Impact of Location

Where you live can affect your insurance costs. Urban areas typically have higher rates due to increased risk.

On the other hand, rural areas may have lower premiums. Consider your location when estimating insurance costs.

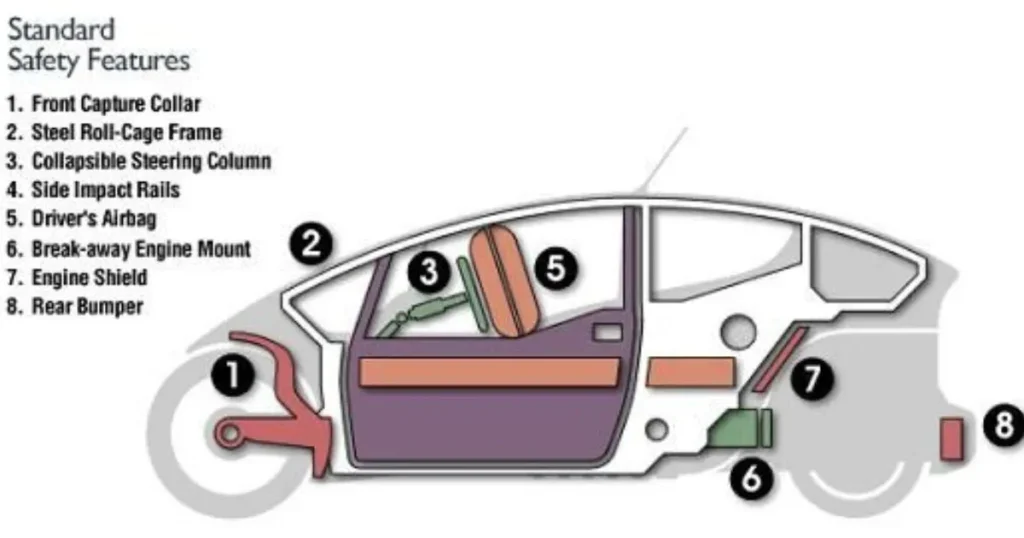

Vehicle Safety Features

Cars with advanced safety features often qualify for discounts. Features like anti-lock brakes and airbags can lower your premium.

Research the safety features of potential vehicles. This can help you save money on insurance.

The Importance of Deductibles

A deductible is the amount you pay out-of-pocket before insurance covers a claim. Higher deductibles usually mean lower monthly premiums.

However, ensure you can afford the deductible if you need to file a claim. Finding the right balance is key.

Comparing Insurance Companies

Not all insurance companies offer the same rates. Research different providers to find the best deal.

Look for reviews and ratings to assess their reliability. A reputable company can save you money and hassle.

Understanding Premium Payment Options

Insurance companies offer various payment plans. You can often choose to pay monthly, quarterly, or annually.

Understanding these options can help you budget effectively. Pick a plan that fits your financial situation.

Re-evaluating After Purchase

After buying your car, re-evaluate your insurance needs. Your coverage may change based on your new vehicle.

Regularly reviewing your policy ensures you have adequate coverage. It also allows you to make any necessary adjustments.

The Benefits of Bundling Insurance

Consider bundling your car insurance with other policies. Many companies offer discounts for bundling.

This can save you money on both policies. Always ask about bundling options when getting quotes.

Seeking Professional Advice

If you’re unsure about estimating insurance costs, seek professional advice. Insurance agents can help you understand your options.

They can also provide personalized quotes based on your needs. Professional guidance can lead to better decisions.

Keeping Up with Insurance Trends

Stay informed about changes in the insurance market. New laws or policies can affect your rates.

Understanding these trends helps you make informed choices. Being proactive can save you money in the long run.

FAQs

How can I estimate my car insurance costs?

You can estimate costs by researching vehicle types, getting quotes, and using online calculators.

What factors affect car insurance rates?

Your age, driving record, credit score, vehicle type, and location influence insurance costs.

Why is it important to compare quotes?

Comparing quotes helps you find the best coverage at the most affordable price.

How do deductibles work?

A deductible is the amount you pay before insurance covers a claim; higher deductibles usually mean lower premiums.

Can my credit score impact my insurance rates?

Yes, many insurers use credit scores to assess risk; a higher score often leads to lower premiums.

Conclusion

Estimating car insurance costs before buying a vehicle is essential. By considering various factors, comparing quotes, and understanding coverage options, you can make an informed choice. Researching vehicle types, reviewing your driving record, and staying updated on insurance trends will also benefit you.