“TIAA Life Insurance offers unique benefits for educators and non-profits. This review covers plans, features, and more for 2024.”

TIAA Life Insurance is a well-known provider, especially among educators and non-profit employees. They offer a variety of insurance options tailored to meet different needs. In this review, we will explore the features, benefits, and drawbacks of TIAA Life Insurance for 2024.

Understanding their policies can help you make informed decisions about your insurance needs.

Overview of TIAA Life Insurance

TIAA was founded in 1918 and specializes in providing financial services. The company mainly serves those in the educational sector and non-profit organizations.

TIAA Life offers both term and permanent life insurance products. Their goal is to help clients secure their financial future.

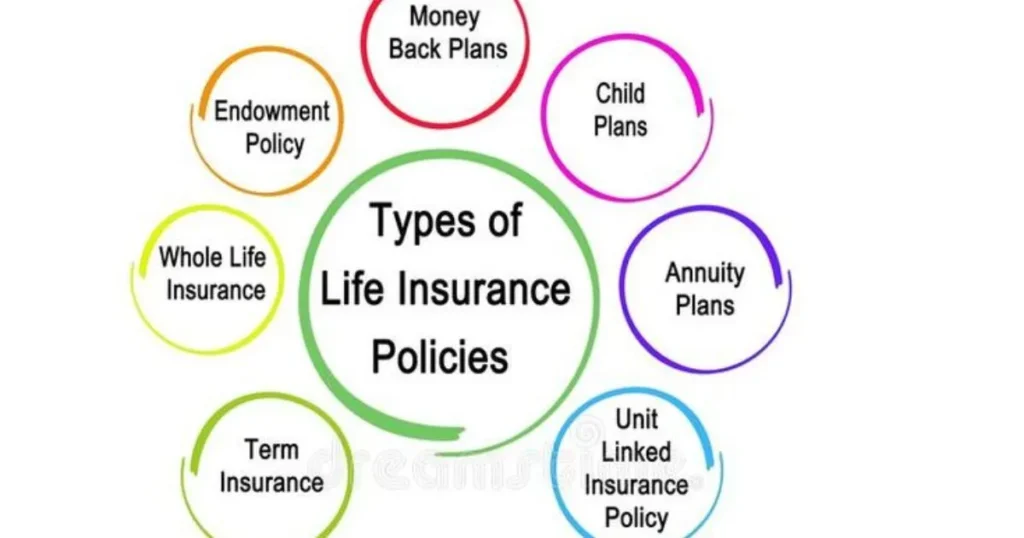

Types of Life Insurance Offered

TIAA provides several types of life insurance. These include term life insurance and whole life insurance.

Term life insurance offers coverage for a specific period, usually 10, 20, or 30 years. It is generally less expensive than permanent policies.

Term Life Insurance Details

Term life insurance from TIAA is straightforward and affordable. It offers protection for a set term without the cash value component.

Policyholders can choose the term length that fits their needs. After the term ends, you can renew or convert to a permanent policy.

Whole Life Insurance Details

Whole life insurance provides coverage for your entire life. It also builds cash value over time, which you can borrow against.

The premiums for whole life are higher but remain level throughout your life. This can provide stability in budgeting.

Benefits of TIAA Life Insurance

TIAA offers several benefits for policyholders. One key advantage is their focus on serving educators and non-profits.

They provide personalized service and support tailored to their clients’ needs. This can make a significant difference in customer experience.

Policy Riders Available

TIAA Life Insurance offers various riders. Riders are optional add-ons that enhance your policy’s benefits.

Some common riders include accidental death benefit and waiver of premium. These can provide additional coverage and financial protection.

What Are Paid-Up Additions in Life Insurance?

TIAA Life Insurance Premiums

Premiums vary based on several factors. These include age, health, and the type of policy selected.

TIAA’s rates are competitive compared to other insurers. It’s essential to get quotes and compare before deciding.

Financial Strength and Stability

TIAA has a strong financial rating. This indicates their ability to pay claims and meet obligations.

The company is highly regarded for its stability and reliability. This can provide peace of mind to policyholders.

Customer Service Experience

Customer service is vital when choosing an insurance provider. TIAA is known for its helpful and responsive service.

Clients can reach out through various channels, including phone and online chat. The company aims to address inquiries quickly.

Claims Process Overview

Understanding the claims process is crucial. TIAA aims to make this process as simple as possible.

Policyholders can file claims online or via phone. The company provides clear instructions to help clients navigate this process.

Common Customer Complaints

Like any provider, TIAA has received some complaints. Issues may include delays in processing claims or difficulty reaching customer service.

However, many customers appreciate the company’s commitment to service. It’s essential to research and read reviews before purchasing.

TIAA’s Unique Offerings

TIAA offers unique features not found with all insurers. Their focus on serving educators and non-profit employees sets them apart.

They provide educational resources to help clients understand their options. This can empower policyholders to make informed decisions.

Comparing TIAA with Other Insurers

When evaluating life insurance, comparing different companies is essential. TIAA’s offerings may suit specific audiences better than others.

Consider factors like pricing, coverage options, and customer service. This will help you find the best fit for your needs.

Customer Satisfaction Ratings

TIAA receives favorable ratings from customers. Many appreciate the personalized service and focus on specific professions.

Reading reviews can provide insight into the experiences of others. This information can be helpful in your decision-making process.

TIAA’s Underwriting Process

The underwriting process assesses your health and lifestyle. TIAA uses this information to determine your premiums and eligibility.

Be prepared to provide personal details during this process. Transparency can lead to more accurate quotes.

How to Apply for TIAA Life Insurance

Applying for TIAA life insurance is straightforward. You can start the application online or contact an agent for assistance.

Ensure you have all necessary documents ready. This may include identification and health information.

Frequently Asked Questions

This section addresses common questions potential customers have about TIAA Life Insurance. Understanding these can help clarify any doubts you might have.

Final Thoughts on TIAA Life Insurance

This Life Insurance offers valuable options for specific audiences. Their focus on educators and non-profits sets them apart from other providers.

Research and compare policies to find the right coverage. Always consider your unique needs and financial goals.

FAQs

What types of life insurance does TIAA offer?

TIAA offers term life and whole life insurance. Each type has different benefits and features.

How can I apply for TIAA Life Insurance?

You can apply online or through an agent. Gather necessary documents to make the process smoother.

What is a rider in life insurance?

A rider is an add-on that provides extra benefits to your policy. Common riders include accidental death and waiver of premium.

How does TIAA handle claims?

You can file claims online or by phone. TIAA provides clear instructions to help you through the process.

Are TIAA’s premiums competitive?

Yes, TIAA offers competitive premiums compared to other insurance providers. It’s wise to get multiple quotes for comparison.

Conclusion

In conclusion, Life Insurance provides solid options for individuals, especially those in education and nonprofits. Their focus on personalized service and unique offerings makes them a noteworthy choice. As you consider your life insurance needs, remember to evaluate all your options carefully. Choosing the right policy can significantly impact your financial future.